The Importance of Research in Strategy: A 5C analysis approach within the RSTP model

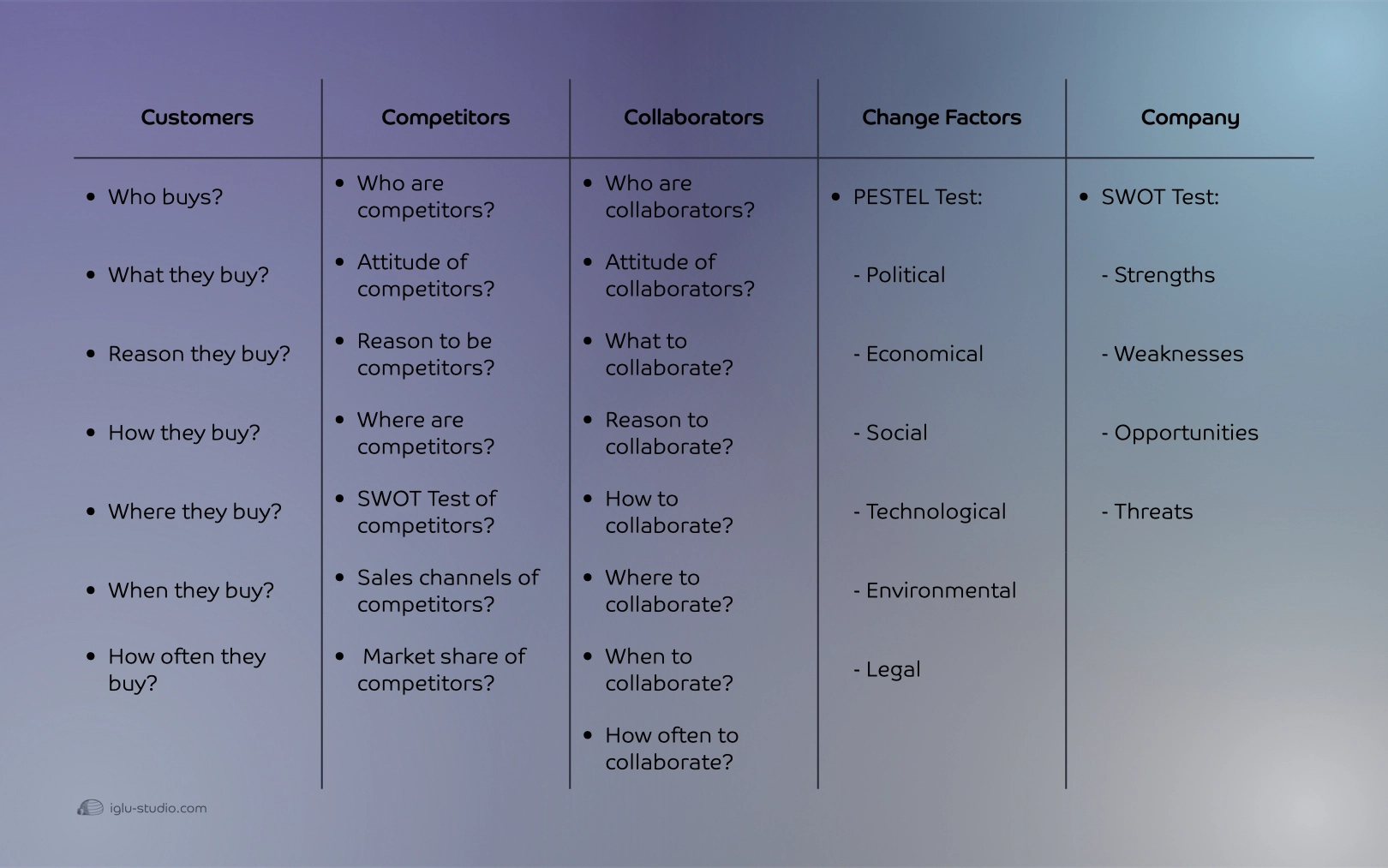

In the article "Brand Positioning: Slicing the market cake and choosing the winning strategic move", we broadly discussed the importance of the RSTP–MM–Implementation–Control model in all marketing and branding decisions. We will now examine in more depth the first stage of this model (Research). The purpose of this stage is to collect unbiased data, conduct precise analysis, and uncover the hidden segments of the market—those overlooked by competitors or whose needs have not been addressed. In this approach, the market is like a complete cake that has not yet been sliced; the more comprehensive our understanding of this cake, the more accurate and successful the next stages—Segmentation and Positioning—will be. The 5C Analysis framework provides a structured method for achieving this objective through five key dimensions: Collaborators, Competitors, Customers, Change Factors, and Company.

1. Customers

Customer analysis goes beyond identifying whoever buys products or services from us, and distinguishes three primary roles:

- End User: The person who directly uses the product or service, such as someone who purchases and uses a software application themselves, or someone who buys a food product and consumes it personally.

- Purchaser: The one who conducts the purchase and payment but is not the end user. These individuals buy products or services for others, and their purchasing decisions are influenced by different factors. For example, a mother buying snacks for her child will have nutritional standards specific to the child’s needs, unlike those for an adult. Similarly, someone buying a gift for a friend or a procurement officer purchasing equipment for employees.

- Facilitator / Recommender: Those who do not directly buy the product but influence others’ purchasing decisions. For instance, a doctor prescribing a specific brand of medicine for a patient is neither the consumer nor the purchaser but significantly impacts product sales. A similar case is an interior designer recommending a specific brand of furniture to clients or an event planner advising a client to outsource catering to a particular company.

Once these roles are distinguished, factors for study in each role typically follow this sequence: Who buys? What do they buy? Why do they buy? Where do they buy? When do they buy? How often do they buy? And so forth.

2. Competitors

Competitor analysis must identify all three tiers of competition:

- Direct Competitors: Those offering similar products. For example, if our business is a fast-food restaurant, other fast-food restaurants serving similar items are direct competitors.

- Substitute Competitors: Businesses offering different products or services that fulfill the same need. For instance, if our business is a fast-food outlet, substitute competitors could be catering services or restaurants serving traditional cuisine, as customers may choose between pizza and a traditional Iranian meal depending on budget or preference.

- Hidden or Potential Competitors: Players capable of entering the target market. For example, a café with potential to expand its menu and operations into a full-service café-restaurant.

Competitor identification should follow analytical factors in sequence: Who are the competitors? Why are they considered competitors? In which segment of the market do they operate? What are their strengths, weaknesses, opportunities, and threats? Which sales channels do they use? What market share do they hold? And so on.

3. Collaborators

Collaborators are critical links in the brand’s value chain and may include suppliers of raw materials or services, distribution partners, branding and marketing agencies, or sales platforms.

Analysis involves examining the following factors in order: Who are the collaborators? What is their behavior and approach? In which areas can collaboration occur? Why collaborate with them? How can collaboration be carried out? Where and when can it take place? How frequently should collaboration happen? And so forth.

4. Change Factors

Macro-environmental change factors are typically analyzed using the PESTEL framework, which is vital for understanding the entrepreneurial ecosystem. Changes at the political, economic, social, technological, environmental, and legal levels directly shape opportunities and threats. In this framework:

- Political factors include government policies, international relations, and political stability.

- Economic factors relate to conditions such as exchange rates, economic growth, and purchasing power.

- Social factors include consumer behaviors, culture, values, and demographic trends.

- Technological factors involve new innovations and emerging technologies that can reshape business models.

- Environmental factors assess sustainability concerns and ecological impacts.

- Legal factors cover labor laws, intellectual property rights, and commercial regulations.

5. Company

The Company dimension focuses on internal evaluation, most commonly using the SWOT Analysis framework:

- Strengths: Tangible or intangible advantages the brand can leverage, such as a robust distribution network or a strong reputation; these are foundations upon which to build sustainable competitive advantages.

- Weaknesses: Limitations or vulnerabilities that hinder growth, such as resource shortages, lack of structured processes, or weak branding.

- Opportunities: Trends or changes that create growth potential, often identified from the Change Factors and Competitors analysis. For instance, a competitor’s weakness might present an opening for us to strengthen that area within our own organization and create a powerful point of distinction in the customer’s mind.

- Threats: Internal or external factors that may slow or halt growth, such as regulatory changes, economic or social instability, or the entry of a strong competitor.

A thorough analysis using the 5C framework in the Research stage not only delivers a full picture of the market, competitors, collaborators, and environmental factors, but also a clear understanding of the organization’s own position. This knowledge empowers businesses to make informed decisions about entering more profitable market segments, designing sustainable competitive advantages, and leveraging opportunities effectively. The intellectual, practical, and time investment in this phase ensures that subsequent stages—from market segmentation and brand positioning to strategy implementation and performance control—are built upon a solid, data-driven foundation capable of steering the brand toward winning strategic choices.